- October 14, 2024

- Posted by: Prashant Gala

- Category: ESG

India is taking bold steps toward combating climate change by launching the Carbon Credit Trading Scheme (CCTS), a key component of its low-carbon economic transition. Officially notified on June 28, 2023, under the Energy Conservation Act 2001, this scheme underscores India’s commitment to reducing greenhouse gas (GHG) emissions and achieving sustainability goals.

What is the Carbon Credit Trading Scheme (CCTS)?

The CCTS establishes a framework for trading Carbon Credit Certificates (CCCs), where each certificate equals the reduction of one tonne of carbon dioxide equivalent (tCO2e). The scheme incentivizes industries to cut emissions, allowing those that surpass reduction targets to sell surplus credits to industries struggling to meet their goals.

The CCTS will unfold in two phases:

- Compliance Market (2026): This phase targets industries with mandatory emission reduction requirements, particularly heavy sectors like steel and petrochemicals.

- Voluntary Market: Open to non-obligated entities, this market allows corporations and individuals to participate voluntarily by registering emission reduction projects and trading Cs.

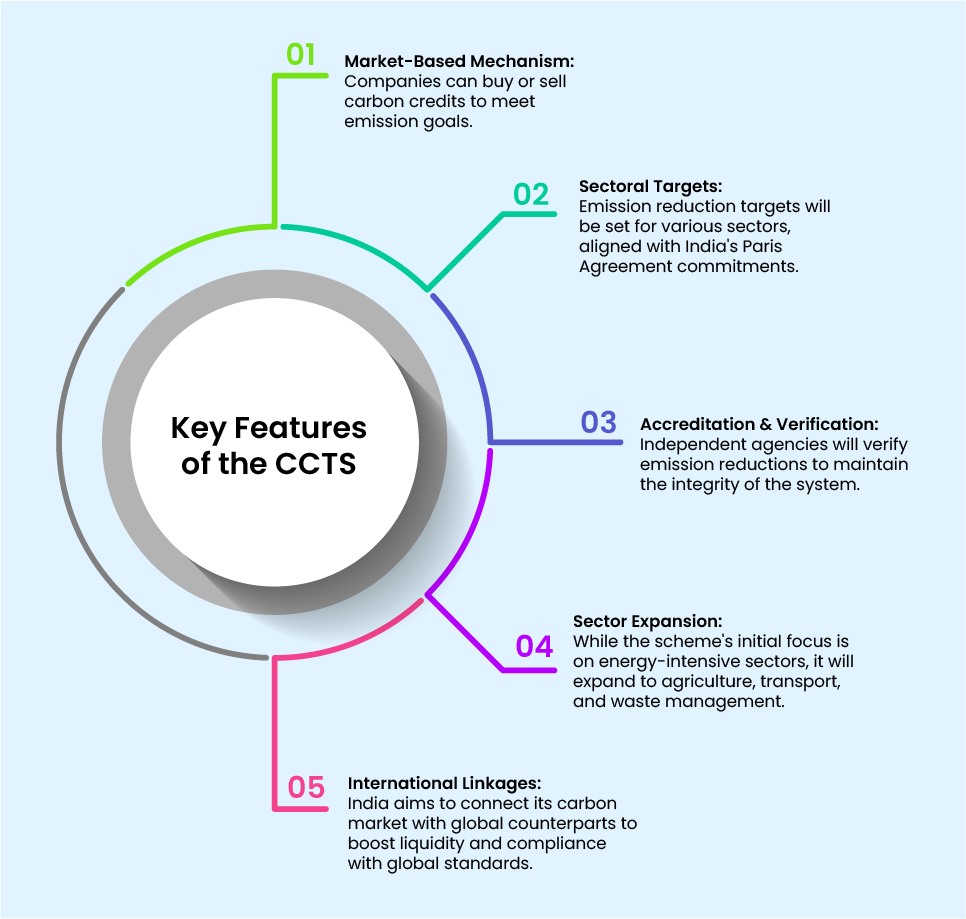

Key Features of the CCTS

1. Market-Based Mechanism: Companies can buy or sell carbon credits to meet emission goals.

2. Sectoral Targets: Emission reduction targets will be set for various sectors, aligned with India’s Paris Agreement commitments.

3. Accreditation & Verification: Independent agencies will verify emission reductions to maintain the integrity of the system.

4. Sector Expansion: While the scheme’s initial focus is on energy-intensive sectors, it will expand to agriculture, transport, and waste management.

5. International Linkages: India aims to connect its carbon market with global counterparts to boost liquidity and compliance with global standards.

Challenges & Future Directions

Despite the promise, the CCTS faces several hurdles:

- Defining Clear Targets: Setting well-defined emission targets across sectors is crucial. Currently, these are under development.

- Ensuring Market Integrity: Transparent regulations will be necessary to prevent market manipulation and ensure the prices of carbon credits reflect the true cost of carbon.

- Capacity Building: Smaller enterprises may need extensive training and support to participate effectively in this complex new market.

- Integration with Global Markets: Aligning the CCTS with international carbon markets will unlock greater economic and environmental benefits.

The Broader Impact of the CCTS

The CCTS will have far-reaching consequences for industries, the job market, and economic growth:

- Impact on Industries: Heavy industries like cement, steel, and power will need to adopt cleaner technologies. While large firms may easily comply, small and medium-sized enterprises (SMEs) may face compliance challenges.

- Job Market: A shift to a low-carbon economy may create new jobs in green sectors but also cause disruptions in traditional industries. Upskilling will be essential.

- Economic Growth: The scheme could attract investments in clean energy, but businesses, particularly SMEs, may initially bear compliance costs.

- Long-Term Benefits: Although companies may face short-term costs, they could ultimately benefit from improved efficiency, reduced energy costs, and greater global competitiveness.

How India’s CCTS Compares Globally

India’s CCTS can be compared to established carbon markets such as the EU Emissions Trading Scheme (ETS) and China’s National Carbon Trading Market. While India’s approach shares similarities with both, it faces unique challenges regarding sectoral targets and enforcement mechanisms.

| Feature | India’s CCTS | EU ETS | China’s Market |

|---|---|---|---|

| Launch Year | 2023 (Operational 2026) | 2005 | 2021 |

| Market Type | Cap-and-trade with offsets | Cap-and-trade | Cap-and-trade (intensity-based) |

| Coverage | Initially heavy industries | Broad sectoral coverage | Power generation, heavy industry |

| Emission Targets | TBD | Absolute reduction targets | Emission intensity targets |

| Free Allowances | TBD | Gradually phased out | Limited free allowances |

How Indium Can Help

As industries grapple with the complexities of carbon trading, Indium plays a pivotal role by offering:

1. Technology Integration & Infrastructure Development

- Data Management Systems: Indium can assist companies in building robust data management systems capable of capturing, storing, and analyzing emissions data in real time. These systems help firms manage their carbon credit transactions and compliance requirements, offering seamless integration with existing IT infrastructures.

Indium’s Carbon Emissions Calculator can enable companies to capture accurate emissions data, thus ensuring they meet reporting standards efficiently.

- Infrastructure Scalability: Given the high volume of transactions expected in carbon markets, Indium can provide cloud-based, scalable solutions that accommodate this trading system’s growing data demands. Secure, distributed data storage ensures transparency and accountability.

Enhance your emissions data management with Indium’s scalable solutions

Explore our Data and AI services

2. Workflow Automation & Efficiency Improvements

- Monitoring and Reporting Automation: Indium’s workflow automation expertise can help firms automate emissions monitoring and reporting processes, drastically reducing the administrative burden. Automated workflows can streamline reporting, verification, and compliance with regulatory bodies, reducing the possibility of human error and ensuring that deadlines are met effortlessly.

- Regulatory Compliance Tracking: Through automated workflows, companies can track compliance with sector-specific emission reduction goals, flag any deviations, and help firms adjust operations proactively.

3. AI-Based Solutions

- Predictive Analytics: Indium leverages AI and machine learning algorithms to predict emission trends, helping industries optimize their processes in line with the CCTS. AI can identify the best opportunities for emission reductions by analyzing operational data and offering predictive insights on energy consumption and carbon output.

- Optimization of Energy Use: Indium’s AI solutions can assist businesses in optimizing their energy consumption, thus minimizing emissions. AI-driven recommendations can help firms adopt more efficient energy practices through better process control, predictive maintenance, or identifying inefficiencies across the value chain.

Leverage AI to optimize energy use and reduce emissions

Discover our Data and AI solutions

4. Digital Platforms for Carbon Credit Trading

- Development of Secure Platforms: Indium’s expertise in building secure, scalable digital platforms will be crucial in enabling seamless carbon credit transactions. These platforms will allow real-time integration of market data, pricing updates, and compliance tracking, creating an efficient and transparent marketplace for trading carbon credits.

- Market Analytics and Insights: The platform can be enhanced with analytics dashboards, allowing traders and regulators to track market performance, trends in carbon pricing, and credit supply-demand patterns. This would enable better decision-making and market liquidity.

Build secure, scalable carbon trading platforms with Indium’s expertise.

Know about our App development services

5. Emission Monitoring & Reporting Solutions

- IoT-Based Emissions Tracking: Indium can implement IoT-based solutions to monitor emissions at various points in the industrial process. These connected devices can provide real-time data on emissions, enabling firms to meet the monitoring, reporting, and verification (MRV) requirements under the CCTS.

- Cloud-Based Analytics and Reporting: By leveraging Indium’s expertise in cloud computing and analytics, firms can gain a centralized platform to collect, store, and analyze emissions data. This helps companies easily meet regulatory requirements and supports strategic decision-making around carbon reduction strategies.

Monitor and report emissions seamlessly with Indium’s IoT and cloud solutions

Discover our Data and AI solutions

Conclusion

India’s Carbon Credit Trading Scheme (CCTS) marks a significant milestone in its climate action journey. By structuring a regulated carbon market, India aims to meet its Nationally Determined Contributions (NDCs) and establish itself as a leader in the global fight against climate change. Although challenges remain, the long-term benefits of the CCTS for industries, the economy, and the environment are substantial.